NEWS ANALYSIS

Tripoli_ The Libyan Foreign Ministry announced Wednesday that Malta will be lifting restrictions imposed on 1,800 bank accounts belonging to Libyan citizens and firms in the Maltese Islands. However, neither the Libyan nor the Maltese officials made it clear as about when would be the exact date of the lifting these restrictions.

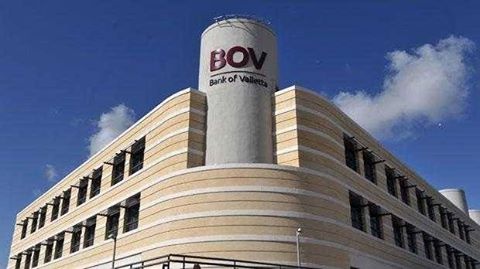

This issue has long been present as unsolved problem in the bilateral relations between Libya and Malta, and it is not clear whether it will be ended on a happy note and as easily as the officials of both countries are saying. The reason is simply stems from the fact that there is a huge amount of money involved, some estimates put it to more than 2.3 billion euros; and that there exists significant pressure exercised on the Maltese banking system by the European Central Bank (ECB), especially on the Bank of Valletta (BOV).

The Acting Minister of Foreign Affairs and International Cooperation, Taher Al-Baour, during a meeting with Malta’s ambassador to Libya in Tripoli on 11 December announced the lifting of the restrictions saying that they will include those imposed by the Bank of Valletta and the Santa Bank, the former St. Julian’s bank that has been liquidated. A set of mechanisms and procedures were also adopted in order for the beneficiaries to be able to recover their funds.

In 2021, the Committee for Lifting Restrictions on the Funds and Property of Libyan Citizens and Public Companies Abroad was established by the Government of National Unity (GNU) to pursue solving such problems and similar cases in Malta and other countries.

The ministry said it would make the necessary advertisements to invite citizens concerned to provide the required documents needed for the recovery process of their rights.

In November 2021, the Deputy Minister for Consular Affairs, Murad Hamima, said, “the Maltese officials confirmed that their country has no intention or desire to target the Libyans’ money in any way, and that the consulate will publish the mechanisms required for the affected citizens to be able to recover their money.”

He said then “the accounts of Libyan citizens frozen in Malta are concentrated in Valletta and Sata banks, and we have completed the inventory of the closed accounts in the Bank of Valletta, numbering 1,800 accounts, and accounts in Santa Bank are still under monitoring as the bank itself is being liquidated,” as reported by the Libyan News Agency LANA.

In early November 2021, Rick Hunkin, Chief Executive Officer of Bank of Valletta (BOV), expressed his readiness to receive the necessary data, to begin the procedures of returning the funds to their Libyan beneficiaries.

On 12 September 2022, Libyan PM Abdulhamid Dbeibeh visited Malta to negotiate the release of millions of Euros in frozen Libyan bank accounts, but he returned home empty handed.

According to media reports, Malta rejected Dbeibeh’s attempt to reclaim frozen funds and government sources said then he was left “disappointed” when Prime Minister, Robert Abela privately turned him down.

Replying to questions after the meeting in Valletta between the Libyan PM and his Maltese counterpart Robert Abela, a Maltese government spokesperson said: “There was no discussion about any particular bank or financial institution. However, there were talks about pending dues owed to Maltese business institutions, including in the healthcare sector. As well as funds which are currently held up in financial institutions for various reasons – including sanctions,” as quoted by the Times of Malta.

In May 2016, the European Central Bank (ECB) put incredible pressure on the Maltese Bank of Valletta (BOV) to close bank accounts opened by some Libyans between 2013 and 2015, the Maltese Independent reported.

The ECB claimed that those accounts “were not subjected to the necessary legal requirements even though the BOV informed the anti-money laundry and anti-terrorism funding authorities in Malta about any suspected bank accounts,” the paper said.

The Independent added that the BOV obtained some documentations that show soaring numbers in deposit levels between 2013 and 2015, pointing out that at the same period the customers’ deposits increased to reach more than 2.3 billion euros.

Therefore, it remains to be seen whether the promises made by the Libyan and Maltese officials to the affected Libyan citizens and firms in Malta will ever be realized. Especially when one looks back to the long history and complexities of the restrictions imposed on the more than 1,800 bank accounts. Simply, the stakes are high; they may involve more than 2.3 billion euros for sure. Not to forget that the ECB and the European Union itself are under a mounting financial pressure as a result of their support for Ukraine in its war with Russia.

As for the Dbeibeh’s government of Tripoli, it, too, is being pressured by those Libyan citizens who own those many bank accounts in Malta. Procrastination will only add to its inability to get things done or, at worse, to be seen as unwilling or incapables to use its political leverage vis-a-vis a foreign country that is not taking Libyan interests into consideration.